how does retirement annuity reduce tax

So the exclusion ratio is 823 100000121500. A fixed annuity is a contract between an investor and an insurance company.

Retirement Annuity Ra Or Tax Free Savings Account Tfsa Which Is Better Sanlam Intelligence Retail

16 hours agoAnnuities can be a great way to save for retirement and receive tax-deferred growth but when it comes time to take distributions or income youll likely have to pay taxes.

. Annuities are a popular choice for investors who want to receive a steady income. 410 Pensions and Annuities. Non-qualified annuity earnings are taxed differently depending on how the income is withdrawn.

Ad Learn some startling facts about this often complex investment product. For both if you withdraw. Withdraw Extra From Tax-Deferred Accounts in Low-Income Years.

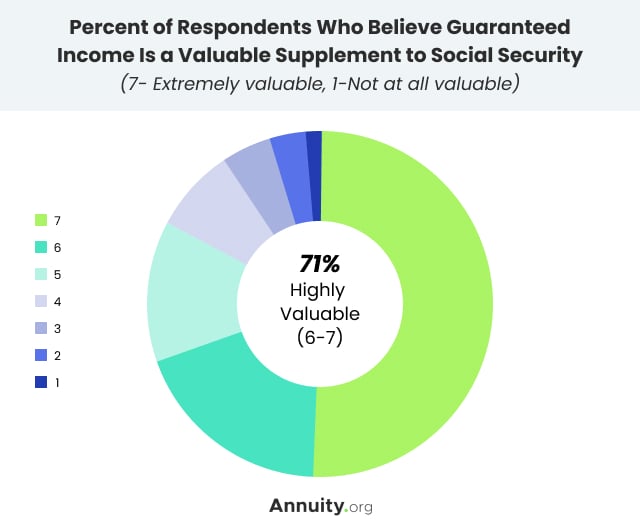

For both these types of annuities the earnings grow tax-deferred until you start. How to Use an Annuity to Reduce or Eliminate Tax on Social Security. The ways the IRS taxes your annuity depends almost entirely on how you received the money you used to buy it.

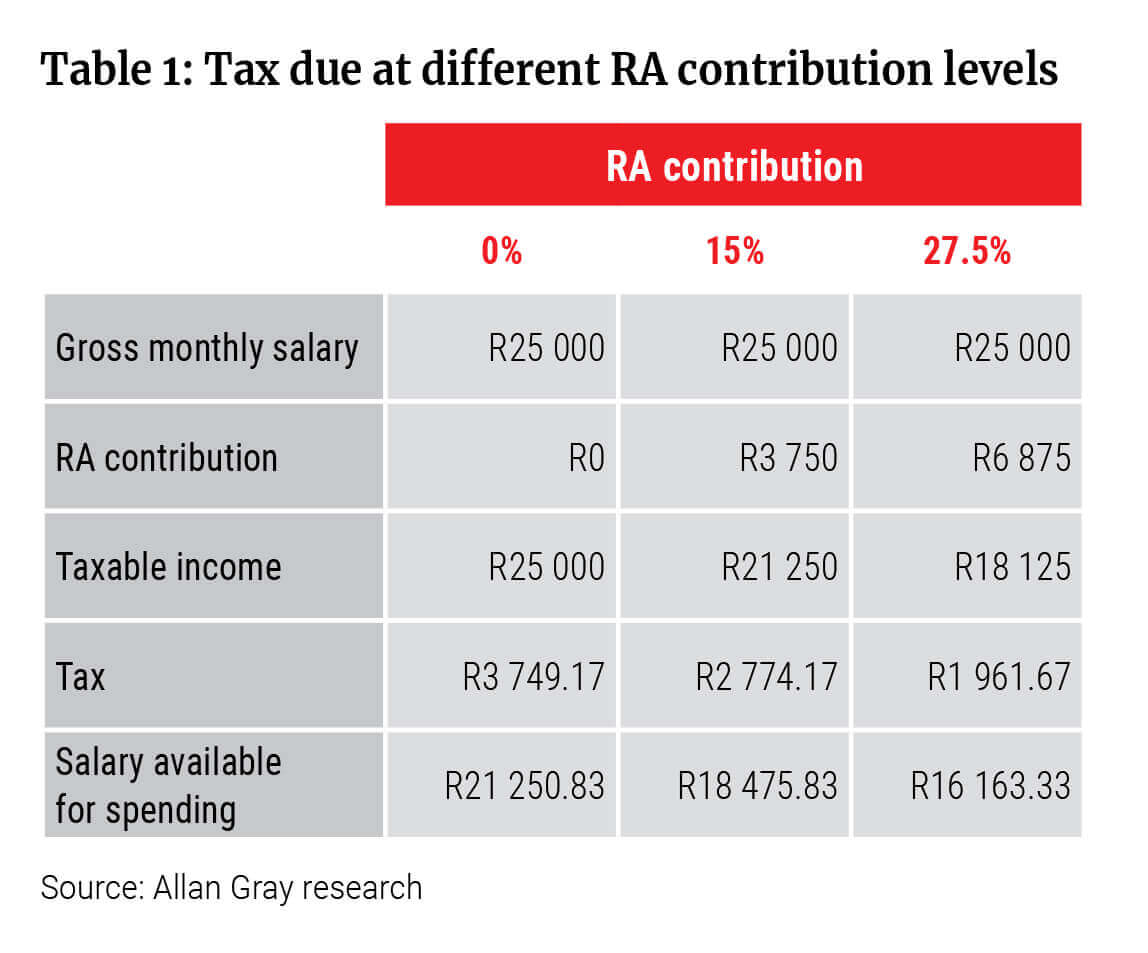

Contributions to an RA are tax-deductible up to 275 of remunerationtaxable income subject to an annual limit of R350000. An annuity is an insurance product that pays out income and can be used as part of a retirement strategy. Traditional IRA traditional 401 k pension or annuity income short-term capital gains bond income and non-qualified dividends income is taxed at your ordinary income rate.

Tax deferral refers to the act of postponing income taxes. When using a qualified annuity such as one in an employers retirement plan or a traditional IRA the contributions you make typically reduce. Regardless of your age if you.

Therefore since 2016 you can contribute up to 275 of your total annual income to a retirement fund the contribution is capped at R350 000 and get a tax refund. Ad What Are Your Priorities. Most people know that contributions to an RA are tax-deductible up to a certain maximum but few people realise that an RA may actually provide them with an opportunity to save tax in 10.

Ad Backed By 100 Years Of Investing Experience. Ad Learn More about How Annuities Work from Fidelity. The prevailing wisdom is to pull money from taxable accounts.

Get Your Free Report Now. If youre single and your income is between 25000 and 34000or between 32000 and 44000 if youre married filing jointlythen 50 of benefits are taxable. Therefore of each payment received 82 is not subject to tax for the next 15 years and this makes immediate annuities a.

If youre under 59 and 12 youll have to pay an early withdrawal penalty fee of 10 to the IRS on the full amount. Individual taxpayers and corporations may defer income taxes by realizing less income during the year. Protect your future with guaranteed growth now and income for life later.

If you receive retirement benefits in the form of pension or annuity payments from a qualified employer retirement plan all or some portion of the. A non-qualified annuity is one purchased with after-tax funds and isnt necessarily a retirement vehicle but it can be. Learn More About What TIAA Has To Offer.

41 lower tax rate. Your tax burden is going to change whether you purchased a qualified. 22 hours agoIn the case of qualified annuities.

Annuities are taxed at the time of withdrawal regardless of the. Ad Learn More about How Annuities Work from Fidelity. It also includes any interest income above R23 400 and any net rental income.

Ad Safe Secure Compound Growth And The Highest Rates. If your company does not have a retirement fund all your income will be non-pensionable. When you take money out of a tax-deferred retirement plan you pay income taxes on the distributions at.

You can save on your long-term tax liability by. Qualified Annuity Taxes. So you can claim.

A deferred annuity does not offer payout until interest is accrued on your contributions. 42 lower tax rate. Tax-deferred annuities allow taxpayers to reduce their taxable income by contributing pre-tax funds to an annuity premium.

The couples have 30 of savings in a traditional IRA invested in a balanced portfolio and are. The investor who is also called an annuitant contributes money to the annuity in exchange for a. Initial Tax Considerations for Annuities.

With Merrill Explore 7 Priorities That May Matter Most To You. Ad 11 Tips You Must Know About Retirement Annuities Before Buying. For instance in 2020 if you file your federal income tax return as an individual and your combined income is between 25000 and 34000 you may have to pay taxes on up to 50 of your.

For example if you. Non-qualified annuities require tax payments on only the earnings. Social Security does not count pension payments interest or dividends from your savings and investments or annuity.

Sequencing withdrawals efficiently from different piles of savings can lead to a lower tax bill in the long run.

Annuity Rollover Rules Roll Over Ira Or 401 K Into An Annuity

Tax Deferral How Do Tax Deferred Products Work

Retirement Annuity How Can I Use An Annuity For Income In Retirement

Required Minimum Distributions Required Minimum Distribution Retirement Calculator Life Insurance Quotes

Ira Rollover Indicates To Move Loan From A Retirement Plan Such As A 401 K 403b Tax Sheltered Annuity Personal Budget Household Budget Budget Categories

Retirement Calculator Spreadsheet Retirement Calculator Savings Calculator Annuity Retirement

Guide To Annuity Fees Fidelity Investments Annuity Investing Guide

Retirement Annuities Is The Tax Refund Worth It Sanlam Intelligence Retail

Taxation Of Annuities Ameriprise Financial

Tax Sale Tax Experts Tax Filing Online Company Tax Tax Income Tax Claim Tax Schedule Teaching Money Economics Lessons Financial Literacy Lessons

Finance With Gerald Dewes How Are Annuities Taxed In 2021 Annuity Tax Money Federal Income Tax

Retirement Annuities Is The Tax Refund Worth It

Allan Gray Part 3 How To Maximise Tax Benefits Before The End Of The Tax Year

Annuity Taxation How Various Annuities Are Taxed

Tax Free Savings Account Vs Retirement Annuity Which Is Better

Retirement Bucket Approach Cash Flow Management Fidelity Positive Cash Flow Cash Flow Cash Flow Statement

How Do Annuities Work Wealthfit Annuity Annuity Retirement Saving For Retirement